I talk to investors every day and pay particular attention to how they’re putting their money to work. If one word sums up their mood right now, it’s this: cautious. The relative calm of the last few years has given way to increased levels of volatility in commodities, equities, currencies and, even interest rates.

On a global scale, monetary policy has – and continues – to undergo a shift. After years of speculation about when the Bank of Canada (BoC) was going to raise interest rates, we got the answer earlier this year: it isn’t – at least not in the short term. The U.S. remains one of the few nations holding on to the belief of a sustained recovery under more normalized Federal Reserve (Fed) policy. The Fed’s current stance to leave the option of raising rates later this year open – stands in sharp contrast to the quantitative easing policies recently introduced in Europe, China, India, etc. and of course to Canada’s recent rate cut.

In an environment of increased volatility, fixed-income investors are treading carefully.

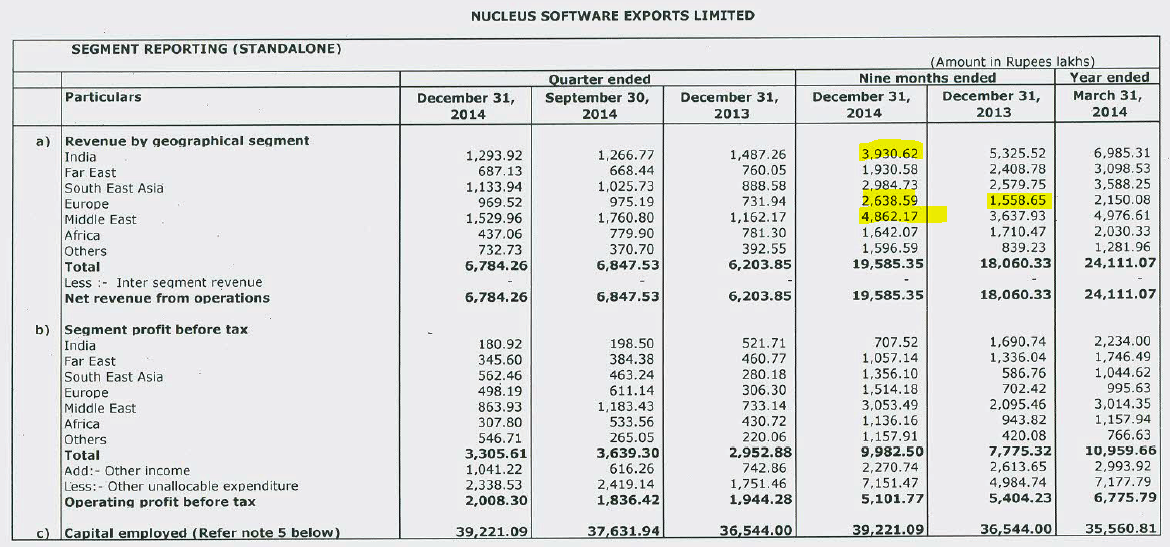

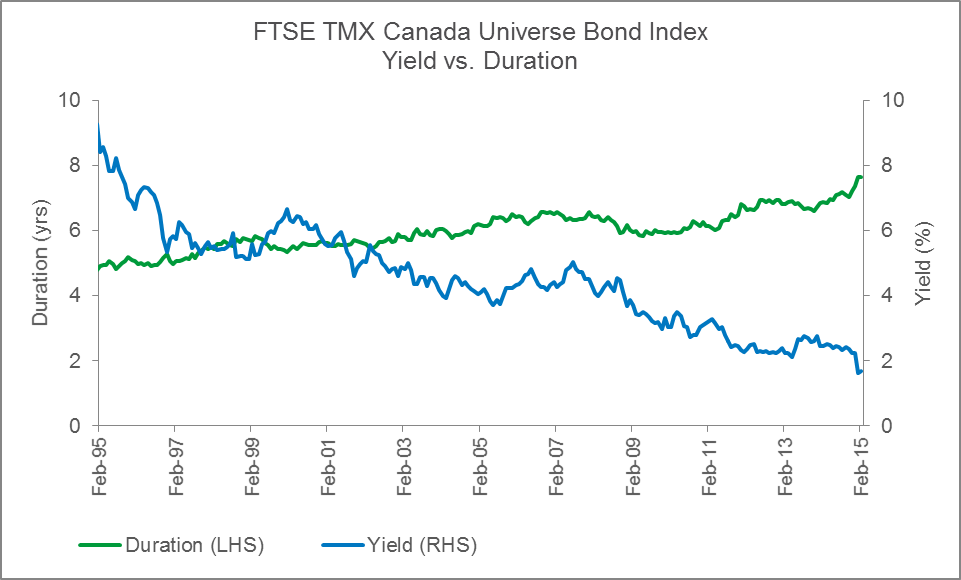

Or at least they would like to. But the need for income remains a central theme for investors. Fixed-income yields are historically low in Canada, and even with the U.S. standing alone in tightening policy, yields remain low as quality-seeking capital flows are coming to America. This lowering of yields has exacerbated another challenge that already existed for traditional bond portfolios: the spread between duration and yield, which exacerbates interest rate risk. The average yield-to-maturity in the Canadian aggregate bond universe (FTSE TMX Canada Universe Bond Index) is 1.69{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}, and its duration is 7.64 years. When duration is that far above yield, then even a small increase in interest rates could decimate income.

Source: FTSE TMX Canada, as of February 28, 2015.

Many of the fixed income investors I talk to feel that they are caught between a rock and a hard place – trying to hedge their bets amid volatility, but punished on the yield side and incurring increasing interest rate risk when they play it safe. They want to stay on the short end of the yield curve to control their interest rate risk but are taking on an increasing amount of lower credit-quality issuers in an attempt to increase their yield. The challenge here is many aren’t as confident making duration calls and even less equipped to have risk controls in place for their high yield exposures.

In response, many are rethinking their traditional bond holdings and exploring other options, including fixed income ETFs. One option for investors seeking to reduce their interest rate risk and increase yield, while still maintaining the overall risk profile similar to a traditional Canadian bond portfolio is the iShares Short Term Strategic Fixed Income ETF (XSI), which seeks to deliver a higher yield with reduced interest rate sensitivity. The fund seeks to achieve this by leveraging BlackRock’s global capabilities to strategically gain exposure to thousands of investment-grade and high-yield bonds from Canada, the U.S., Europe and emerging markets. This is done by investing primarily in other iShares ETFs. For many investors, hedging at least a portion of their fixed income portfolio against interest rate risk will always make sense. XSI offers investors a fixed income solution that may deliver a more balanced risk profile of credit and interest rate risk than the traditional Canadian bond universe.

There’s no doubt that these are interesting times for fixed income investors, who are increasingly starting to think about bonds differently. The good news is that today more than ever, they have options.

Pat Chiefalo, Managing Director, Head of iShares Canadian Product for BlackRock Canada.

iShares® ETFs are managed by BlackRock Asset Management Canada Limited. Commissions, trailing commissions, management fees and expenses all may be associated with investing in iShares ETFs. Please read the relevant prospectus before investing. The funds are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional.

© 2015 BlackRock Asset Management Canada Limited. All rights reserved. iSHARES and BLACKROCK are registered trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. Used with permission. iSC-1678

SOURCE: BlackRock Blog | Global Market Intelligence – Read entire story here.