I was in India and recently tuned into CNBC TV 18 after ~5 years for few days. I heard only one sensible thing on this channel. It came from Sanjoy Bhattacharya, “In my life, albiet short in itself, I have never seen an Auto Component Manufacturer at 80+ times earnings – BOSCH India, so there is something wrong.”

I also had joint pain and to fix that I read ~half a dozen books last month. I came to the conclusion that best of the best doctor in any corner of the earth knows much less than 0.0001{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of mechanics inside the body. I knew the level of ignorance already as my wife was PhD in Microbiology but did not know the yawning chasm. Like Munger, its best to take the finest offerings of all the paradigms, nutritional science, ayurvedic science of doshas, rhythms, primal elements that circulate in body like air, fire, and deeper dimensions of body, modern allopathic diagnostics etc. For nutrition, book by Dr Joel Furhman titled “Fasting and Eating for Health” may be your best 10$ spent ever on health. Second best on nutrition, Terry Wahls – The Wahls Protocol.

I generally spend 6 – 8 hours a day related to investments, not that it always helps. Was reading how 1 Lac INR invested in SYMPHONY LTD. in 2005 India, turned into 2600 Lacs in 2015, did I even make 26 Lacs from each Lac invested when I got in 2009 ? I have nothing but eerie silence. The best investment in a short life is one that moves in your favoured direction within a year or two. Major part of the portfolio needs to be geared towards that.

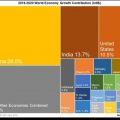

I think finally I have (fingers crossed) found a company that should compound topline 25{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} during this decade (atleast has been for past five), bottomline even faster. If, re-rated, which is highly likely, 40-60{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} Cagr during the next ten years. The feeling I am getting is of extremely heady intoxication, just the same as when I bought Page Industries at 350 Rs in 2010 at 10 times earnings, and recommended to my friends/clients all the way until 4000 Rs two years back. The company is outside India, growing at 30{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} CAGR, debt free, roe (and all that jazz), available at 10 times earnings and is a monopoly (more than market leader). More on that later.

In India, I think the C grade and B grade has performed better than A grade over the past 18 months. Look at 52 Week High Lows, and you will know what I mean. First time ever, mid and small caps are richly valued across the board. At these levels some companies in India that I still like are Sarup Industries, Dewan Housing, Gulshan Polyols, Ambika Cotton, Kovai Medical. One of the most abominable statements blurted out by tuxedo clag gang on business channels is “For long term i.e. 5-7 years, 20{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} CAGR is possible”. This statement is recounted when Acrysil is 100 or 700 a year later, this is yet again repeated ad fininitum whether Gulshan is 60 Rs or 350 Rs an annum later. So, the sooner you ignore and start turning stones around yourself, the better. Gladly, value investing is a message in vain for majority.

An interesting assertion from Vivekananda was along the lines, “I would not go to school, but rather train my mind for 24 years, and in the 25th year put in information from books of all the libraries of the world”. Accordingly, a fantasy to get extremely wealthy, is to work on your mind to recall your past life, bury gold in a forest before kicking the bucket in this life, start your new life with a bounty of gold dug and hidden in previous life each time. So, in a few lifetimes you can own the planet, you know what even 7{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} compounding on principal of 10,000$ is for 400 years is right? More than 100{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of all assets on the planet! , so please be contented with 5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} compounding.

While 5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} may be undercutting, I often get requested to please divulge more risky equities, that can offer higher returns. That assumes Risk is a lever to be turned on to Increase returns. Facts are quite the opposite.

SOURCE: Long Term Equities – Read entire story here.