I review the list of dividend increases every single week, as part of my monitoring process. A long history of dividend increases is an indication of a quality company with a competitive advantage in its industry. I use the combination of length of streak of consecutive annual dividend increases and dividend increases as part of my toolkit to monitor the breadth of dividend universe. It helps me be on top of existing holdings and potentially identifying companies for furher research.

This is of course an exercise that is in addition to my regular process of scanning the dividend growth investing universe, and monitoring my list. There are a few extra steps involved, such as reviewing trends earnings, dividends, and trying to understand the company. Even a great company is not worth buying however, if it doesn’t sell at the right price.

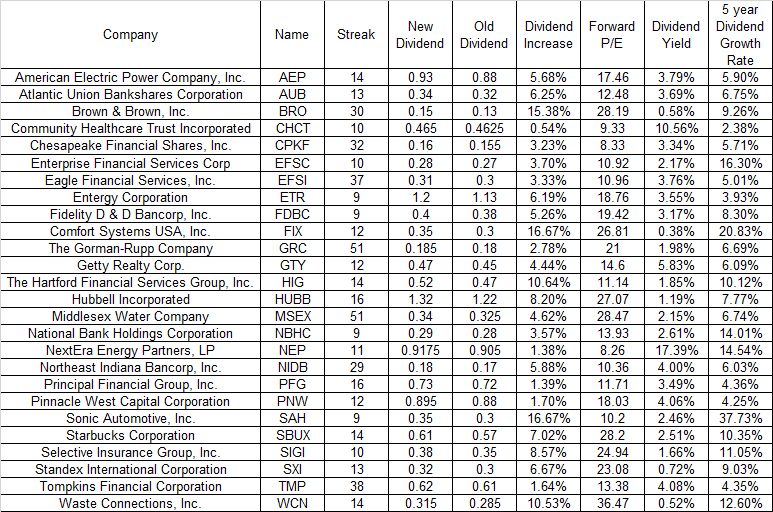

Over the past week, there were 42 dividend increases in the US. I narrowed down the list by focusing only on the companies that raised dividends last week, but also have a ten year track record of consecutive annual dividend increases. The companies are listed below:

Obtaining an understanding behind the company’s business is helpful, in order to determine how defensible the dividend will be during the next recession. Certain companies are more immune to any downside, while others follow very closely the rise and fall in the economic cycle.

Relevant Articles: