POUND STERLING ANALYSIS & TALKING POINTS

- Don’t be fooled by UK GDP beat!

- Low growth environment weighs negatively on pound.

- GBP/USD bears eye bear flag breakout.

Elevate your trading skills and gain a competitive edge. Get your hands on the British Pound Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

Recommended by Warren Venketas

Get Your Free GBP Forecast

GBPUSD FUNDAMENTAL BACKDROP

The British pound was relatively unchanged after the UK GDP report (see economic calendar below) beat forecasts on most metrics. That being said, the broader picture shows a struggling economy that remains depressed with the 3-month average figure reaching yearly lows, teetering around negative growth. Business investment was the largest downside surprise revealing the tough economic conditions for businesses as a result of tight monetary policy.

GBP/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

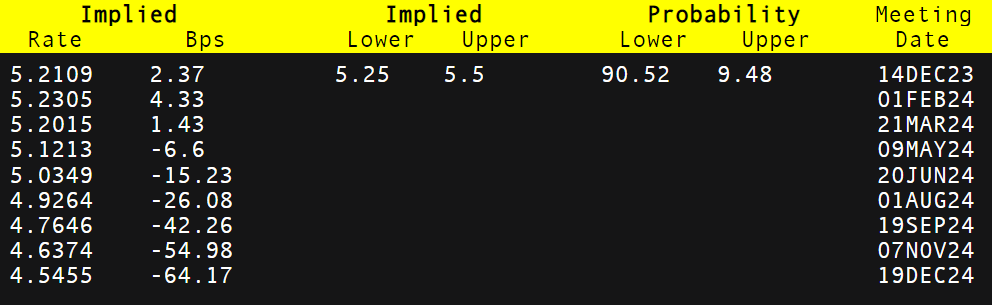

Bank of England (BoE) interest rate expectations (refer to table below) stay in favor of a rate pause in the December meeting but should markets witness subsequent weak economic data, we may see a stronger dovish bias despite pushback from the BoE’s Governor Andrew Bailey.

BOE INTEREST RATE PROBABILITIES

Source: Refinitiv

TECHNICAL ANALYSIS

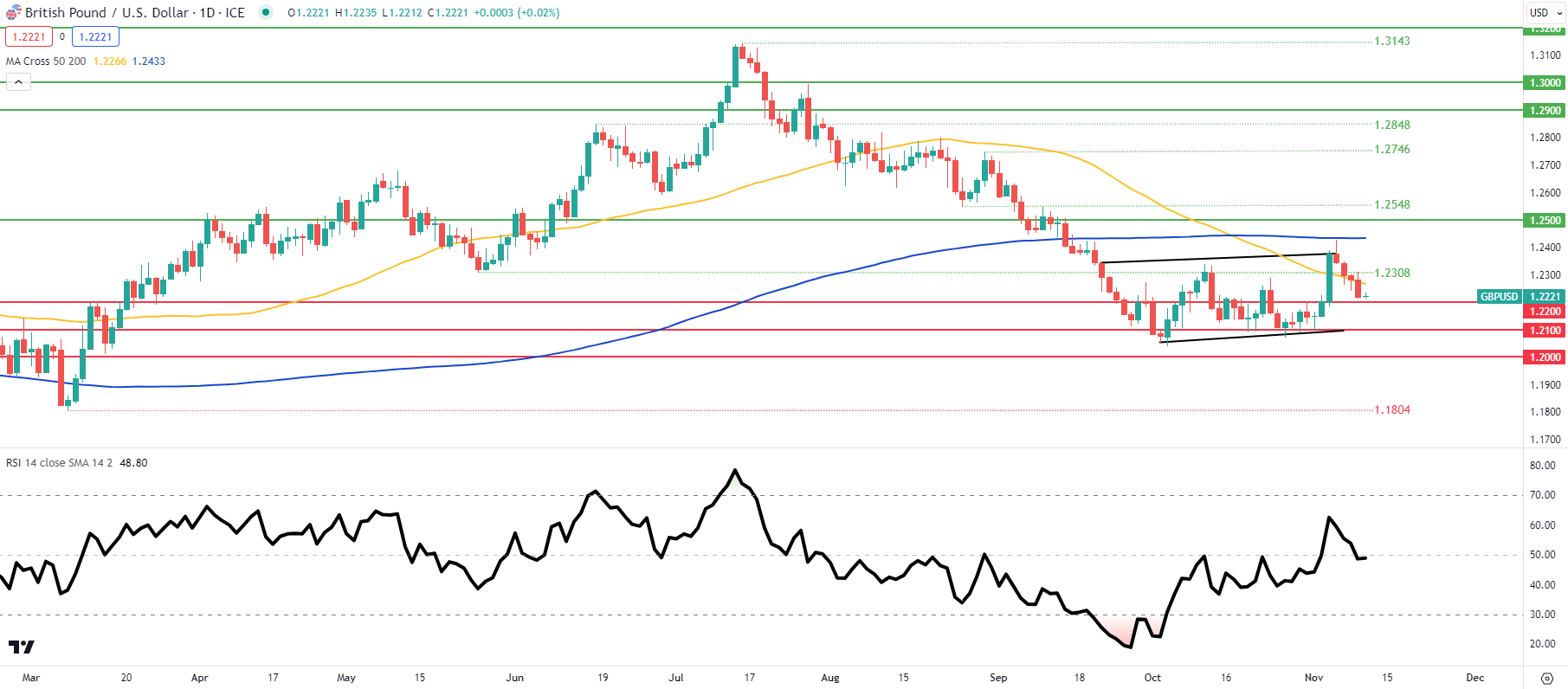

GBP/USD DAILY CHART

Chart prepared by Warren Venketas, IG

GBP/USD price action extends its recent downtrend post-GDP and now looks to test the 1.2200 psychological handle once more. The bear flag (black) pattern is still under consideration but will need to see additional downside towards flag support.

Key resistance levels:

- 200-day MA (blue)

- Flag resistance

- 1.2308

- 50-day MA (yellow)

Key support levels:

- 1.2200

- 1.2100/Flag support

- 1.2000

- 1.1804

MIXED IG CLIENT SENTIMENT (GBP/USD)

IG Client Sentiment Data (IGCS) shows retail traders are currently net LONG on GBP/USD with 70% of traders holding long positions (as of this writing).

Curious to learn how market positioning can affect asset prices? Our sentiment guide holds the insights—download it now!

Introduction to Technical Analysis

Market Sentiment

Recommended by Warren Venketas

Contact and followWarrenon Twitter:@WVenketas